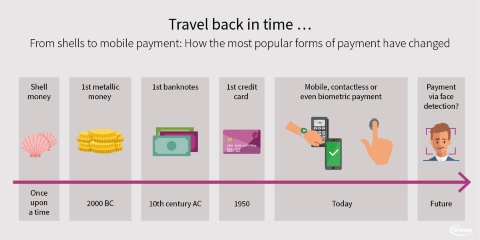

Mobile payment revolutionizes how we pay for things. It replaces cash and traditional credit cards with payment apps on smartphones, wearables, and contactless money cards. In this article, we explain how that works, and the benefits and challenges of mobile payment.

Residents of Beijing can make it through the day without cash, if they want to, but rarely without their smartphone. In supermarkets or restaurants they pay via app. That also goes for the electricity, phone or gas bill. They use the payment app AliPay to call a taxi and pay for the ride when they reach their destination.

The smartphone app is also used for online shopping. AliPay, with its more than 900 million users, is far from being the only payment app in China, however. The messaging service WeChat also has an integrated payment service that is used by around 600 million people. As early as in 2016, both apps were used to move almost three trillion dollars, according to a United Nations study. That’s a little less than the gross domestic product of Germany in 2016, as a study conducted by the International Monetary Fund confirms.

What is mobile payment?

Mobile payment is cashless payment, usually via mobile devices like smartphones or tablets, but also on fitness trackers, smartwatches or smart rings. In concert with the mobile Internet, these devices enable a new way of paying for things that’s convenient, flexible, and also saves time. Accordingly, mobile payment is equally attractive for financial service providers, retailers, and consumers.

Mobile payment is a global trend. China is one of countries driving the boom, with smartphones already being used there in everyday life for mobile payment as a matter of course. According to the “China Mobile Payment Report 2017,” the transaction rate has grown by 381 percent – within a year.

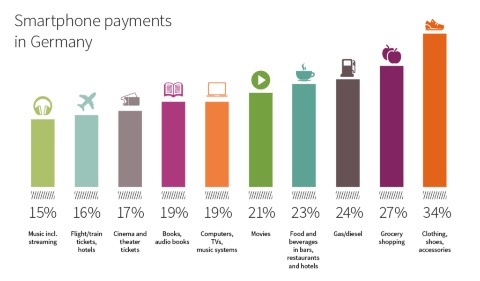

Germany is lagging behind in an international comparison, with German consumers being more skeptical. They fear hacker attacks, for instance, and are concerned about data privacy. 47 percent prefer to stick with cash and 25 percent with debit and credit cards, at least for the time being, according to a GfK study conducted for the German Banking Association. In addition, mobile payment is not generally free. Just like credit cards incur fees, mobile payment providers demand a fee for their service. That includes, for example, fees for the account, for topping up credit, for transactions, or for payments abroad.

How does mobile payment work?

There are two options for mobile payment: If someone uses their smartphone to make an online purchase, they use what’s referred to as remote online payment. This requires a credit card or a PayPal account, for instance. PayPal is a service for sending money virtually to other people. The account is topped up in advance, or the amount is withdrawn from the user’s bank account. Depending on the method used, the user enters their credit card details into the smartphone app or logs into PayPal with their e-mail address and password.

If, in turn, the user is standing in front of a ticket vending machine or at the checkout in a store, they can use the “contactless payment” method, which is made possible primarily through the near-field communication (NFC) technology, but also through QR codes as well as Bluetooth in the future. Depending on the provider as well as the country, the user has to enter a PIN or sign when exceeding a pre-defined amount. Thanks to methods like CDCVM (Consumer Device Cardholder Verification Method), regular card PINs or the signature can be replaced by authentication via fingerprint, face recognition or the PIN of the mobile device.

NFC payment system: How the technology works

NFC stands for near-field communication. Just like Wi-Fi and Bluetooth, it involves two chips communicating wirelessly with each other, but with a slower data transfer rate. In addition, the chips cannot be more than four centimeters apart, which means that only small amounts of data can be transferred. NFC is being used in more and more areas, such as data exchange, mobile payment or ticketing. Users of most car sharing services also unlock their rental car with an NFC card or an NFC-enabled smartphone. The benefit: It’s faster and more convenient than entering a PIN or having to sign something. At the same time, it’s difficult to intercept the transferred data. Unlike credit card payments, all the data is transferred in encrypted form.

How to pay with a smartphone, wearable or smartcard

For contactless payment to work, stores, on the one hand, have to be equipped with appropriate card terminals and offer the service. The mobile payment option is advertised with an icon comprising four white arcs.

On the other hand, the buyer or customer needs an NFC-enabled device for contactless payment. Such devices can be credit cards or smartcards with a radio chip, as well as smartphones and wearables like a fitness tracker or a ring. Smartphones and the like also require the right payment app. Vodafone customers, for example, can use the provider’s Wallet app. Other services are also available (see sidebar). To complete a purchase, the user opens the payment app and holds the device or card at a distance of no more than 4 centimeters from the terminal. Depending on provider and country, the user also has to authenticate himself with the used device, enter the card PIN or sign. Payment is first confirmed by a beep, and “OK” is then shown on the display. The transaction is thus completed very quickly.

In countries like the U.S., China, Japan and the UK, smartphone users can pay via the payment system of their respective phone manufacturer. The services are linked with the credit card companies and can be basically used wherever contactless payment is available. Germany is following step-by-step: In June 2018, Google went first with its payment service Google Pay. At the end of 2018, Apple Pay also entered the market – around four years after its launch in the U.S.

Mobile payment with prepaid apps and Bitcoin

There are other ways to make mobile payments, even without an NFC-enabled smartphone or payment card. Customer apps offered by the Rewe and Edeka supermarket chains, for example, allow customers to pay by scanning a QR code. The provider Cashcloud offers an NFC chip on a sticker that users affix to their mobile phone. With Cringle and PayPal, users send money via e-mail or text message to companies or other users.

Boon and Pey are providers that differ somewhat from the various payment systems. Boon is a prepaid service for Android devices. Before the users pays for something, they have to top up their Boon account via bank transfer or credit card.

Instead of euros, users can also pay using the purely digital Bitcoin currency – at least wherever it’s accepted. The startup Pey has developed a wallet app for making purchases directly in stores, but at this point it only works in Hanover. A number of online shops do, however, allow payment with Bitcoins. The decentralized and anonymous payment system works without a connection to banks and is considered secure thanks to its blockchain technology. A blockchain is a digital cash ledger that Bitcoin users administer jointly.

Mobile payment systems at a glance

A distinction is generally made between closed and open payment systems. In closed systems, customers are more limited, since this is where individual retail chains each offer their own payment app that can only be used in their stores. Open payment systems allow mobile payment in any store with appropriate payment terminals. For this, retailers bring third-party providers on board to operate the service: so-called mobile wallet platforms.

Various payment systems are currently in operation worldwide:

- Closed systems:

- Aldi, Edeka, Lidl, McDonald’s, Media Markt, Netto, Rewe, Shell, Starbucks, Uber, Vapiano, VW

- Open systems:

- AliPay, Apple Pay, Bitcoin Wallet, Boon, cashcloud, Coin, Cringle, Deutsche Bank DB Mobile Banking App, Fidor SmartCard, Girogo, GO4Q, Google Pay, Intuit GoPayment, MasterCard MasterPass, Microsoft Wallet, Payback Pay, Paydiant, PayPal Mobile, Pey, Samsung Pay, Square Order, Visa Checkout, Vodafone Wallet, WeChat

- Points of acceptance: Supermarket checkouts, ticket vending machine, gas stations, parking meters, soccer stadiums

Safety and challenges

How secure is mobile payment, and what are the challenges?

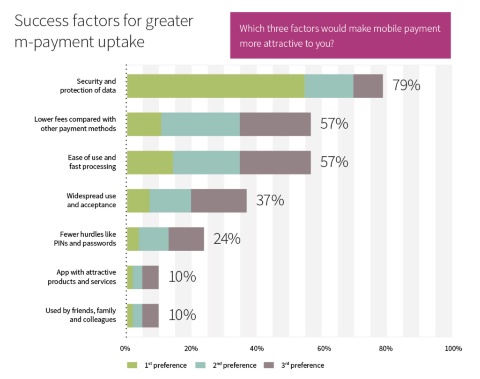

For German consumers, security always plays a major role, and mobile payment is no exception. For 79 percent of users, it has top priority for making mobile payments according to a survey carried out by consulting firm PwC. But where do the risks lie?

Consumers fear that their data could be intercepted and misused before, during or after a payment transaction. In addition, several items of information are linked together: purchase and payment data with location data, making it easy for data thieves to generate a user profile.

However, technology companies are developing increasingly secure and innovative chips for NFC-enabled devices that store sensitive payment data in a secure environment.

There are two major reasons why NFC technology is considered secure: The signal range is limited to a few centimeters, and data is transferred in a safe form. Users wanting additional protection against hackers can buy special, shielded cases for smartphones, for instance. Stealing money via NFC, however, is a rather bad idea, since most transactions are made via registered scanning devices and can therefore be traced.

But what happens when the user loses their smartphone, wearable or payment card, or if they’re stolen? Such a loss should, of course, be reported as soon as possible, but the damage will most likely be limited, because the thieves would have to authenticate themselves via the mobile device or enter the card PIN for higher amounts.

An additional option is helpful in the case of payment cards: An e-mail or text message is sent to the customer every time a transaction is made, which means fraud is exposed early on and can be stopped by the providers.

Global security standards

There are also global security standards for mobile payment – the same as for card payments. They were defined by the largest international credit card companies, including Mastercard, Visa, JCB, American Express, Discover, and Union Pay. For ticket solutions, Infineon also relies on CIPURSE, the industry’s only open and flexible security standard.

Development and future

How we will pay

Experts are certain that mobile payment will be the dominant payment method of the future, as more and more solutions with various models are becoming established worldwide. For example, Swedes no longer pay, they “swish”. In 2016, 43 percent of the country’s citizens used the Swish app for transactions, according to its operator. In South Africa, supermarket customers verify their purchase with a biometric Mastercard by using their fingerprint, while the Chinese counterpart will soon use facial recognition. In Kenya, a Vodafone subsidiary introduced the simple M-Pesa mobile payment service as early as 2007. Today, it’s used by more than 30 million people to pay small amounts via credit stored on the SIM card.

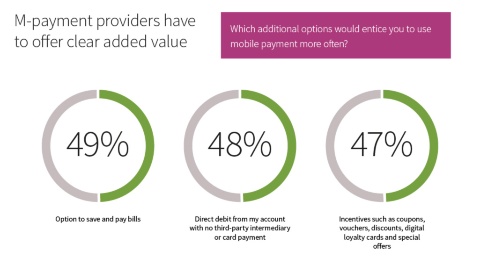

According to the PwC study, the majority of Germans are open to mobile payment too. They want a payment app that’s not only secure, but also practical. That requires uniform standards and that users can use one system to pay everywhere.

Advantages and disadvantages of mobile payment

- Advantages

- No change needed anymore for parking tickets or other small amounts.

- Faster payment transactions at checkouts or bus and train turnstiles.

- Wallets containing cash, and credit and bonus point cards can be dispensed with. That’s not only practical, but also effectively counters robbery, theft, money laundering and illicit work.

- Paying abroad is easier because there are no language barriers and everything works the same everywhere.

- Improved accessibility for the visually impaired.

- With open payment services, users no longer need to remember the PINs for a host of different payment service providers.

- Disadvantages

- Users generate transaction data that has to be protected.

- Cybercriminals have another point of attack.

- Since purchases are registered, more targeted advertising with personalized offers is possible.

- Users are dependent on the technology and on current security standards.

- Mobile payment is still too complicated for consumers in Germany.

The most important questions and answers at a glance

Mobile payment is first and foremost cashless payment, usually via mobile devices like smartphones or tablets. However, fitness trackers, smartwatches or smart rings are being used increasingly. Basically, mobile payment is possible just about anywhere: in restaurants, supermarkets and taxis, when shopping online or paying the electricity bill. The time-saving, convenient and flexible process means mobile payment is an alternative to cash or credit card that is equally attractive for financial service providers, retailers, and consumers.

Generally speaking, a distinction is made between two forms of mobile payment. In remote online payment, purchases are made in an online shop using a smartphone. To pay, the user requires a credit card or a means of sending money virtually – such as from a PayPal account. Contactless payment works differently: Cashless payment is made directly at the checkout or vending machine. Near-field communication (NFC), where two chips communicate with each other wirelessly, can be used for that, but only with low data transfer rates and over a short distance. That makes the technology particularly secure.

For contactless payment to work, stores have to be equipped with an appropriate card terminal and customers need an NFC-enabled device. The right payment apps must also be installed. A distinction is made here between closed systems of specific retail chains and open systems from third-party providers that can be used in various stores.

Convenient, flexible, yet time-saving: The advantages of mobile payment are attracting more and more customers worldwide. No more small change is needed when parking, paying abroad is far easier, and even long waits in the supermarket line are eliminated, since paying is handled faster and faster. Even wallets with credit cards and cash might become superfluous in the future. That is not only practical, but also effectively counters robbery, money laundering and illicit work. Payment will also be simpler in future for people with a visual impairment. Users of open payment apps also have the advantage that they only need to remember one PIN.

Many consumers fear that their data could be intercepted and misused in a mobile payment transaction. In addition, payment and purchase data might be linked together with location data, meaning user profiles could be created and advertising personalized even further. Consequently, data protection has top priority for most consumers when making mobile payments. That is why increasingly innovative chips in the devices ensure that payment data is stored in a secure environment and so protected against access. In addition, cash is debited via NFC only using registered scanning devices – so transactions can be traced by the bank. In Germany, customers must enter a PIN or sign for amounts exceeding 25 euros.

Mobile payment is regarded as the future. New technologies are being developed worldwide, while new providers and new users are getting on board. In China alone, the rate of mobile payment transactions grew by 381 percent in 2017. What is now important moving ahead is to also establish a comprehensive infrastructure of NFC-enabled payment terminals in other countries. In addition, the payment process should be made more uniform, where possible. An exciting aspect in that regard: Industry giants like Apple Pay, Android Pay or WeChat also want to enter markets like Germany in the near future.

Last update: October 2017